BUSINESS

Smart Money Moves During Financial Hardships

Financial hardships can strike unexpectedly, turning stable routines upside down and creating new obstacles to overcome. When times are tough, thinking strategically about your finances is crucial for maintaining control and paving the way to recovery. Leveraging flexible lending costs, such as MaxLend loans, can provide temporary relief, but long-term stability comes from planning and prioritizing your next steps.

By taking action early and focusing on a few key principles, you can reduce stress, keep your options open, and put yourself in the best position to weather uncertain circumstances. Financial resilience is possible for anyone willing to adapt and make informed decisions in the face of hardship.

Build an Emergency Fund

Securing an emergency fund should be a top priority during uncertain times. Aim to save at least three to six months’ worth of essential living expenses in a separate, liquid savings account. This emergency cash reserve serves as a shield against sudden expenses such as medical bills, job loss, or urgent home repairs, and prevents the need to rely on high-interest credit cards or loans during a crisis. According to CNBC, building even a small emergency fund can help reduce financial anxiety and keep you afloat when unexpected challenges arise.

Pay Down High-Interest Debt

Managing high-interest debt becomes especially important during financial downturns. Debts such as credit card balances or payday loans typically carry annual interest rates far above other forms of borrowing. This makes them a high priority for quick repayment. Reducing high-interest balances improves your monthly cash flow, lowers your stress level, and helps you avoid a cycle of growing debt. When resources are limited, focus on either the avalanche or snowball method: pay as much as possible towards the highest-rate debt or start small and build momentum by paying off the smallest debts first.

Reevaluate Your Budget

Financial strain often demands a change in spending habits. Take the next 30 days to track every expense, no matter how insignificant it seems. This detailed review can help you discover where your money actually goes and show you opportunities to cut back. Do you have unused subscriptions, unnecessary fees, or services you are overpaying for? Budgeting tools and apps are invaluable for this process. Services such as Rocket Money can automate subscription management or negotiate bills for you, helping to stop small expenses from becoming an ongoing drain on your resources.

Explore Additional Income Streams

In times of financial hardship, creating new income opportunities is more important than ever. Consider side jobs or freelance work such as gig driving, remote freelancing, selling unused items online, or leveraging specific skills for contract work. A side hustle not only supplements income but also gives you flexibility if your primary job is uncertain or hours are reduced. Websites like Indeed offer ideas and guidance on finding side gigs to help close the gap when ends don’t meet.

Invest Wisely

Striking a balance between paying off debt and investing for the future is essential. While aggressively attacking high-interest debt, investing money when your debt’s interest is lower than potential market returns can be a smarter wealth-building strategy. Historically, the stock market has yielded returns of 7% to 10% annually. If your debt’s interest rate is below this range, prioritize minimum payments and invest any extra whenever possible. This approach maintains your financial flexibility and helps maximize long-term growth.

Seek Professional Financial Advice

Getting guidance from a financial professional is invaluable during tough times. A financial advisor can help you develop a personalized plan that reflects your specific circumstances, whether you have lost a job, experienced a significant life event, or simply want greater peace of mind. In fact, according to CNBC, the majority of wealthy Americans work with financial advisors to navigate change and invest wisely. An expert can provide practical solutions and keep you focused on priorities you can control.

Protect YourSignificantit Score

Maintaining a strong credit score can make all the difference when borrowing or refinancing is required. Even if you are not planning to take on new debt, missed payments and high balances can quickly drag down your score, limiting your options. Always pay at least the minimum amount due on all bills, communicate with lenders if you need temporary hardship assistance, and monitor your credit report for errors or fraud. Protecting your credit score now keeps future financial avenues open, especially when economic times are uncertain.

Delay Major Purchases

During financial hardship, delay major purchases such as vehicles, electronics, or vacations until your financial footing is more secure. Large expenses can create long-term obligations that add stress during a period of instability. Using a sinking fund, where you save gradually for planned big purchases, allows you to avoid unnecessary loans or high-rate credit. Rely on cash or planned funds instead of putting more on credit, preserving your flexibility for true emergencies.

By implementing these practical money moves, you can reduce anxiety, maintain your financial health, and build a foundation for future stability. Adaptability and informed decision-making are your greatest allies in overcoming financial hardship and achieving lasting security.

BUSINESS

How Content Management Systems Empower Teams

Organizations today produce a steady flow of digital content across websites, internal platforms, and customer touchpoints. As teams expand and communication channels multiply, keeping information organized and up to date can become challenging. A content management system (CMS) helps structure this process by centralizing content creation, editing, storage, and publishing within a single accessible platform. Instead of relying heavily on technical teams for every update, contributors from different departments can collaborate more efficiently while maintaining consistency and accuracy.

A well-implemented CMS also supports clearer workflows and accountability. Features such as permission controls, version tracking, and approval pathways reduce confusion and help teams stay aligned on messaging. Over time, this structured approach improves productivity and reduces the risk of outdated or inconsistent content. When exploring available platforms, organizations may come across providers like Material offers content management solutions as part of their broader evaluation. Ultimately, the value of a CMS lies in its ability to simplify collaboration, strengthen governance, and support sustainable digital operations without adding unnecessary complexity.

Enhancing Collaboration

Collaboration is at the core of high-performing teams, and modern content management systems are specifically built to foster this dynamic. Instead of scattered documents and inconsistent workflows, CMS technology brings contributors together into a single, accessible location. Features like shared workspaces, version control, and real-time editing allow team members to work simultaneously without risking lost information or duplicated effort. Granular permissions ensure that the right people have access, while audit logs provide oversight and accountability. Organizations with strong internal collaboration are more likely to outperform competitors and drive successful digital transformation.

Streamlining Content Creation

User-friendly CMS platforms make it easier for non-technical staff to participate in content creation. Drag-and-drop editors, templating tools, and guided workflows let teams quickly assemble and customize content for each campaign or product launch. Marketers can launch landing pages independently, while writers and designers contribute assets that are instantly accessible to their colleagues. These self-serve capabilities free up IT and development teams to focus on strategic initiatives. Ultimately, streamlined creation means brands can launch campaigns faster, respond to trends, and iterate on their messaging without delays or bottlenecks.

Facilitating Multichannel Distribution

Getting content to audiences wherever they are requires agility and technical flexibility. A headless CMS allows businesses to manage content centrally, then deploy it to a website, ecommerce platform, app, or emerging digital devices with ease. This model not only ensures messaging remains consistent but also drastically reduces manual rework across channels. For example, a retail brand launching a flash sale can synchronize product announcements across its website, mobile app, email, and even voice assistants from a single dashboard. Multichannel readiness helps organizations scale outreach while maintaining quality control, meeting customers wherever they engage.

Leveraging AI for Content Management

Artificial intelligence has elevated what CMS platforms can achieve. Built-in AI tools can automatically tag, categorize, and even generate content, helping teams manage large volumes of information more effectively. Personalization features adapt website messaging based on user preferences, while advanced analytics highlight what is working and where improvements can be made. Natural language processing helps optimize readability, grammar, and SEO. AI-powered content governance also supports regulatory compliance and brand consistency, making it easier for teams to publish trustworthy, polished content at scale.

Improving Compliance and Security

With data breaches and regulatory requirements on the rise, CMS platforms have stepped up their compliance and security features. Automated audit trails track every action, which is crucial for regulated industries such as healthcare and finance. Integrated validation and approval workflows ensure only authorized content goes live, helping protect organizations from accidental or malicious errors. Security updates and access controls are continuously improved to guard against evolving threats, and centralization makes it easier to enforce policies across distributed teams. By embedding these controls in daily workflows, organizations can meet regulatory obligations and safeguard customer and organizational data.

Boosting Marketing and Technical Efficiency

The latest generation of content management systems adopts a modular architecture that supports both marketing agility and technical innovation. Marketers benefit from cloud-based tools that allow for instant campaign launches, A/B testing, and workflow automation. Meanwhile, technical teams can quickly integrate other software or services using APIs and modular plug-ins, keeping digital infrastructure nimble and future-proof. This combination yields higher ROI, faster project delivery, and easier scaling as organizational needs change.

Future Trends in CMS

The future of CMS is shaped by greater integration with artificial intelligence, real-time collaborative editing, and sustainable digital operations. AI will not only generate and personalize content but also offer predictive insights and optimization recommendations. Design systems will increasingly merge with content management, creating environments where shared components can be reused and updated instantly. Meanwhile, headless and static-site approaches powered by the latest cloud technology will improve both performance and energy efficiency. As CMS platforms continue to evolve, businesses must stay informed and adapt to maintain their digital advantage.

Conclusion

Content Management Systems play a pivotal role in empowering teams by enhancing collaboration, streamlining creation, enabling multichannel outreach, and supporting compliance and security. As digital expectations rise and workplace dynamics evolve, a robust CMS provides the structure and flexibility organizations need to succeed. By harnessing the capabilities of modern content management technology, organizations can create and deliver impactful content, drive better outcomes, and remain competitive now and into the future.

BUSINESS

Home Insurance Basics: What Every Homeowner Should Know

Purchasing a home marks a major achievement and, with it, significant responsibilities. One of the most essential steps all homeowners should take is securing the right home insurance. The right coverage not only provides peace of mind but also safeguards your investment against losses from natural disasters, theft, and other unexpected events. For those eager to protect their homes and finances, comparing online homeowners insurance quotes is a crucial first step toward finding comprehensive, affordable policies.

Understanding how home insurance works ensures you are prepared, both legally and financially, should the worst happen. By learning about policy types, what they cover, and how to keep premiums manageable, you will be ready to make informed decisions and choose the policy that best suits your unique needs.

Home insurance policies can be complex, with different providers offering varying coverage and benefits. By staying aware of policy details and frequently reviewing your insurance needs, you can avoid surprises when you need your coverage most. Exploring coverage options, limitations, and exclusions will enable you to tailor your policy to changing needs or circumstances.

What Is Home Insurance?

Home insurance is designed to protect homeowners from financial hardship caused by damage to the house or its contents, or by potential legal claims arising from injuries on the property. In most cases, your lender will require home insurance if you have a mortgage. Even for those who own their home outright, insurance remains an important layer of protection, safeguarding against catastrophic losses from events such as fires, storms, or burglaries.

Beyond physical losses, many policies offer liability coverage that can help with legal expenses if someone sues for injuries sustained on your property. Coverage can also extend to your personal property, whether stolen or damaged, and may include help with living expenses if your home becomes uninhabitable.

Key Coverages in Home Insurance

A typical home insurance policy includes the following types of coverage designed to protect both the structure and the possessions inside:

- Dwelling Coverage: This is the backbone of home insurance, covering repairs or rebuilding of your home’s physical structure if it is damaged by a covered peril such as fire or windstorm.

- Personal Property Coverage: This portion covers loss or damage to personal items, including clothing, furniture, appliances, and electronics, whether the loss occurs inside or outside the home.

- Liability Protection: If someone is injured on your property and decides to sue, this coverage helps with legal and medical expenses, up to the policy limits.

- Additional Living Expenses (ALE): If your home is rendered uninhabitable by a covered event, ALE helps cover temporary accommodation and living expenses until repairs are completed.

Common Exclusions in Home Insurance Policies

No insurance policy covers every possible risk, so understanding common exclusions is key. Some perils typically excluded from standard home insurance policies include:

- Flood Damage: Most standard policies exclude losses from flooding. Owners in flood-prone areas will need a separate policy from the National Flood Insurance Program (NFIP) or a private insurer.

- Earthquakes: Damage from seismic events is not typically covered and usually requires a separate earthquake insurance policy.

- Maintenance Issues: Problems that arise from poor upkeep, wear and tear, or long-term neglect are not covered. Repairs for mold, rotting wood, or pest infestations generally fall outside standard coverage.

Determining the Right Coverage Amount

Getting the right amount of coverage is vital for protecting your home without overpaying for unnecessary protection. Start by making sure your dwelling coverage equals the cost to rebuild your home at today’s prices, including materials and labor. When it comes to personal property, creating a comprehensive home inventory will help you estimate the replacement value of your belongings, ensuring you are not underinsured in the event of a disaster. For those with unique collections, antiques, or valuable heirlooms, consider endorsements or floaters for extra protection. Lastly, review your liability limits to make sure you are well-protected in the event of a lawsuit or injury claim. A local or independent insurance agent can help you identify the coverage amounts appropriate for your situation and local risks.

Tips for Reducing Home Insurance Premiums

Homeowners can employ several strategies to reduce premiums without compromising coverage. Raising your deductible is a straightforward way to lower your monthly payment, though it means you will pay more out of pocket if you need to file a claim. Bundling policies, such as home and auto insurance, can unlock multi-policy savings with most insurers. Installing monitored alarm systems and fire sprinklers can qualify you for additional discounts, as can upgrading locks or windows. It’s also smart to comparison shop for better deals periodically, as rates may fluctuate and new promotions can help lower your overall costs. For expert advice on switching providers effectively, see this Kiplinger article on re-shopping for home insurance.

Importance of Regular Policy Reviews

Home insurance needs are not static. Changes in your life or property should prompt policy reviews. Home upgrades, such as adding a new deck or undertaking significant renovations, increase your home’s replacement value and should be reflected in your policy. Similarly, if you acquire jewelry, art, or high-value electronics, your personal property coverage may need to be updated. Changes in local building costs can also affect the amount of insurance needed to cover a total loss. Annual or biannual reviews with your agent are recommended to ensure your coverage remains aligned with your needs and circumstances.

- Notify your insurer about all major improvements or additions to your property.

- Update your inventory of personal belongings as you make significant new purchases.

- Review local building regulations or trends to adjust your dwelling coverage as needed.

Conclusion

Making informed decisions about your home insurance can protect both your property and your peace of mind. Learning the basics, identifying the right coverage, and proactively managing your policy are all critical steps for ensuring you have proper protection against life’s uncertainties. By staying informed, regularly reviewing your policy, and leveraging trusted resources, homeowners can secure comprehensive coverage without unnecessary expense, ensuring that their most valuable asset remains well-guarded for years to come.

BUSINESS

Automate Expense Tracking for Your Rapidly Growing Business

Effective expense management lies at the heart of sustainable business growth. As organizations expand, accurate and efficient financial tracking is vital to keeping budgets under control and maximizing each dollar. For companies looking to modernize, more innovative automated systems can transform the way expenses are tracked and managed. To understand how these systems can empower your organization, learn more about advanced expense management solutions that support business agility and drive operational excellence.

As manual spreadsheets give way to intelligent platforms, businesses benefit from faster processes, increased accuracy, and greater transparency. These improvements not only save time but also deliver reliable insights that fuel better decision-making and long-term stability. In an increasingly digital workplace, agile financial solutions have become an asset for teams eager to optimize operations and control costs. Smart integrations and cutting-edge tools now enable finance professionals to shift their focus from data collection to strategic priorities.

By automating repetitive administrative tasks, companies can minimize human error and increase productivity. Automated tracking helps pinpoint spending trends, uncover hidden costs, and identify savings opportunities. This shift prepares organizations to tackle scaling challenges while maintaining robust compliance and secure data management.

The market for automated expense management is rapidly advancing. Top software providers are continually launching features that simplify integration with existing systems and expand analytics capabilities. Achieving a seamless user experience requires ongoing education and a willingness to embrace digital transformation, as highlighted by recent industry trends on Forbes.

Importance of Automated Expense Tracking

Manually tracking expenses can lead to lost receipts, miscalculations, and time-consuming audits. Automated expense tracking offers a transformative solution by eliminating many of these pitfalls. By reducing reliance on manual data entry, finance teams can cut processing time by up to 75 percent, freeing up valuable resources. Transitioning to automation not only streamlines workflows but also drives cost savings by reducing errors and increasing visibility into company spending.

For growing businesses, financial management efficiency is not just a convenience; it is a competitive necessity. Automation enables organizations to keep pace with increased transaction volume and evolving regulatory requirements, according to Wise experts. Companies that embrace these solutions early are better positioned for scalable growth and resilient operations.

Integration with Financial Tools

The value of modern expense-tracking systems lies in their ability to integrate with your existing accounting software and financial platforms. These integrations eliminate the need for redundant manual entry, drastically reducing the risk of discrepancies or duplicated information. With seamless data flow, leadership gains real-time visibility into expenses, enabling more informed decisions and proactive budget management.

Furthermore, integrations streamline employee workflows. Instead of juggling multiple applications for receipts, approvals, and reconciliation, centralized platforms ensure all stakeholders use the same, up-to-date data. Such unified systems allow business owners and finance professionals to quickly identify spending irregularities, track compliance, and adjust policies as business needs evolve.

AI-Driven Solutions for Compliance and Anomaly Detection

Artificial intelligence is rapidly changing the way businesses maintain financial integrity. AI-powered expense tracking automatically categorizes spending, flags transactions that do not comply with company policy, and recognizes patterns that may indicate waste or fraud. This layer of automated oversight helps organizations enforce compliance while reducing the administrative pressure on staff.

Machine learning algorithms can continually improve with each new data point. Over time, AI-driven systems learn to distinguish legitimate exceptions from potential red flags, offering more insightful suggestions and automating reconciliations. For organizations committed to best-in-class governance and operational efficiency, these tools are indispensable. More details on these innovations can be found at Stanford Report.

Cloud-Based Platforms for Accessibility and Scalability

Leveraging the cloud allows for secure, round-the-clock access to financial data from any internet-connected device. This accessibility is vital for teams that are remote or dispersed across multiple locations. Cloud-based expense platforms sync information in real time, making it easy to collaborate and maintain accuracy regardless of where individuals operate.

Cloud technology’s automatic updates, backups, and robust security controls reduce the burden on internal IT departments while providing peace of mind regarding data integrity. Organizations can scale usage to match growth, adding users, features, or integrations as they expand without significant infrastructure investments.

Real-Time Financial Insights

The real power of automated expense tracking lies in the shift from static, historical data to dynamic, actionable intelligence. As all approved expenses flow into real-time dashboards, leadership teams gain a comprehensive view of organizational finances at any given moment. Such access enables businesses to monitor departmental spending, quickly address budget overruns, and optimize future cash flow.

Real-time reporting liberates teams from the constraints of monthly or quarterly close processes. Instead, decisions can be made proactively and emerging risks mitigated before they impact the bottom line.

Enhancing Security in Expense Tracking

As the volume of financial data grows, the risk of cyber threats and internal fraud increases. Advanced expense management platforms are incorporating blockchain and other technologies to safeguard sensitive information. By creating immutable transaction records and leveraging multi-factor authentication, businesses can strengthen both compliance and stakeholder trust.

Robust security protocols are essential not just for meeting legal requirements but also for preserving the reputation and lifespan of modern enterprises. Staying ahead of security trends in expense management is discussed further in this NJCPA article.

Overcoming Challenges in Implementing Automated Systems

Implementing new systems can be met with hurdles, from budget concerns to staff resistance. Many organizations find success by rolling out automation in stages, focusing on one business unit or use case at a time, and actively involving employees throughout the process. This gradual adoption helps teams build comfort with technology and demonstrates measurable value early on.

Open communication, targeted training, and responsive support structures can ease the transition, ensuring that digital transformation delivers on its promise of efficiency and growth without disrupting daily operations.

Conclusion

For any growing company, smarter expense tracking is no longer a luxury but a necessity for maintaining control and fostering sustainable progress. Automated, AI-enhanced, and cloud-based platforms grant businesses the agility to respond to market changes, ensure compliance, and transform expense management from a logistical task to a strategic advantage. By investing in the right tools today, organizations pave the way for a financially sound and scalable future.

-

TOPIC7 months ago

TOPIC7 months agoSymbols of Hope: The 15th Belenismo sa Tarlac

-

TOPIC7 months ago

TOPIC7 months ago“The Journey Beyond Fashion” – Ditta Sandico

-

NEWS7 months ago

NEWS7 months agoHistorical Churches in Manila

-

TOPIC7 months ago

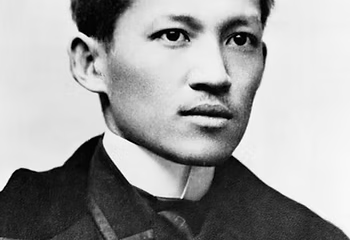

TOPIC7 months agoRIZAL at 160: a Filipino Feat in Britain

-

TOPIC7 months ago

TOPIC7 months ago5 Must-Have Products From Adarna House to Nurture Your Roots

-

TOPIC7 months ago

TOPIC7 months agoBoats with Two Strings

-

TOPIC7 months ago

TOPIC7 months ago“Recuerdos de Filipinas – Felix Laureano”

-

TOPIC7 months ago

TOPIC7 months agoFilipino, alternative language course at Moscow State University