BUSINESS

Achieving Competitive Edge Through Strategic Pricing

In today’s fast-paced business environment, companies face constant pressure to balance profitability with customer expectations. The ability to set prices strategically can often determine a business’s success in competitive markets. Beyond simply covering costs or matching competitors, strategic pricing involves understanding market dynamics, customer behavior, and the perception of value. Organizations that approach pricing thoughtfully can optimize revenue, maintain market share, and create long-term customer loyalty. Pricing decisions are no longer based solely on intuition; data-driven insights and analytical tools have become essential in identifying opportunities for differentiation and growth.

Advanced solutions, such as Revenue Analytics manufacturing pricing software, play a key role in enabling companies to make informed pricing decisions. By analyzing historical data, market trends, and cost structures, businesses can identify patterns and predict optimal pricing strategies. This approach ensures that pricing decisions are both responsive to changing conditions and aligned with overall business objectives. Ultimately, leveraging strategic pricing as a tool for competitive advantage requires a combination of analytical rigor, market awareness, and continuous refinement of pricing policies.

Understanding Strategic Pricing

Strategic pricing is a crucial tool for businesses seeking to optimize profitability while maintaining competitiveness in the market. Unlike simple cost-plus pricing, which focuses solely on covering expenses, strategic pricing considers multiple factors, including customer demand, competitor pricing, and perceived value. By analyzing these elements, companies can establish prices that not only attract customers but also reinforce their brand positioning and long-term business objectives. This approach allows businesses to respond effectively to market fluctuations, optimize revenue, and maintain a sustainable profit margin.

Implementing strategic pricing requires careful research and continuous monitoring. Businesses must track market trends, assess customer behavior, and evaluate competitors’ actions to make informed adjustments. Tools and software can help automate this process, providing real-time insights and forecasts. Ultimately, understanding strategic pricing empowers companies to make data-driven decisions, balancing profitability with customer satisfaction, and creating a pricing strategy that supports growth, market relevance, and financial resilience in an ever-changing economic landscape.

Key Components of Strategic Pricing

Building an effective strategic pricing strategy requires mastery of several critical foundations, each reinforcing the business’s ability to make pricing a true competitive advantage and to weather unpredictable market forces over time:

- Market Research: Understanding your audience—what they need, perceived value, and price sensitivity—is essential. Using surveys, focus groups, and interviews helps develop an effective pricing model that improves conversions and customer satisfaction. Analyzing competitors and substitutes reveals critical pricing thresholds and customer tipping points.

- Competitive Analysis: Monitoring competitors’ pricing strategies is crucial. It allows you to identify gaps, differentiate your offerings, and avoid price wars. Regular benchmarking can reveal opportunities for value-based premium pricing, especially when linked to innovation or enhanced services.

- Value-Based Pricing: This strategy focuses on the benefits that customers perceive, rather than simply applying a markup to costs. By doing so, it can enhance profit margins and differentiate your offerings, ensuring that customers feel they are receiving good value for their money. When managed properly, this approach allows companies to capture more value and make informed investment decisions.

- Dynamic Pricing: Today’s prices are often flexible. Automated systems adjust prices in real time based on demand, seasonality, or market conditions. During high-demand periods, prices increase, while lower-demand times attract buyers with discounts, as seen in airlines, hotels, and online retailers that use real-time algorithms.

Benefits of Strategic Pricing

Companies that adopt strategic pricing reap many advantages. Setting prices based on perceived value enhances profit margins and helps differentiate offerings, enabling companies to defend or even increase prices with clear communication of value. Transparent and well-explained pricing builds trust, which in turn boosts customer retention, encourages repeat purchases, and fosters a positive reputation, ultimately supporting growth. It also streamlines sales processes, enabling the quicker closure of high-value deals and fostering stronger customer relationships.

Dynamic pricing techniques provide the flexibility to respond swiftly to shifts in customer preferences, demand, and competition. This adaptability helps achieve profit and sales volume targets while managing supply chain, regulatory, and raw material fluctuations without sacrificing margins. Moreover, strategic pricing fosters a culture of ongoing improvement across marketing, sales, operations, and finance, enabling organizations to stay agile and responsive to market dynamics.

Challenges in Strategic Pricing

While the upsides of strategic pricing are compelling, shifting to such an approach isn’t without hurdles. Robust, data-driven pricing requires investment in technology and analytical skills—without these, decision-makers may rely on guesswork or outdated information. Many organizations find that the amount of data required to make informed pricing decisions can be overwhelming if proper analytical tools aren’t implemented. Sometimes, internal resistance to change within a company can slow the adoption of new pricing systems.

Managing customer perception is also critical. If prices are seen to fluctuate too often or without clear justification, buyers may lose trust or delay purchases. Transparent communication, clear rationales, and consistent messaging help address these concerns. Ensuring your sales and customer support teams can speak knowledgeably about pricing changes is crucial for maintaining long-term loyalty.

Finally, any significant pricing change risks sparking competitive responses. If rivals launch aggressive counter-offers, there’s always the danger of a price war. Smart companies monitor competitors but avoid knee-jerk undercutting, focusing instead on continuous innovation and unique value. Carefully calculated responses—rather than rushed reactions—help companies sidestep destructive competitor cycles that can erode margin across the sector.

Real-World Applications

Leading companies show that tailored pricing strategies significantly boost revenue growth. Research suggests that customizing prices based on sales channels and customer segments can increase revenues by up to 30%. This method appreciates distinct customer needs and their willingness to pay, helping align prices with perceived value. For instance, a major electronics firm segmented its market into direct, distributor, and e-commerce channels. By leveraging data analytics and adaptable pricing tools, they discovered each segment’s willingness to pay, gained new market share, and improved margins. This resulted in higher profits and enhanced customer satisfaction, underscoring the impact of sophisticated pricing strategies. These findings emphasize the importance of ongoing adjustments. Companies should invest in technological solutions and adopt a culture of continuous pricing experimentation, testing, and learning to drive innovation and improve their pricing strategies. Agile pricing practices enable small-scale pilots, evaluation of outcomes, and rapid adjustments—minimizing risks and unlocking additional revenue streams.

Conclusion

Strategic pricing isn’t just an operational task—it’s a foundational business capability. With a blend of deep market understanding, robust competitor intelligence, and value-driven pricing models, organizations can establish leadership positions in even the most competitive industries. By overcoming technical and cultural challenges, those who prioritize strategic pricing set themselves up for sustained differentiation and durable profitability. In a business world where margins are constantly under pressure, strategic pricing may be the most reliable lever for sustainable competitive advantage.

BUSINESS

How Cloud-Based POS Systems Differ From Traditional POS

Restaurant POS systems have evolved significantly over the past decade. What was once a simple cash register with local software has become a connected platform that manages transactions, reporting, menus, and integrations across multiple channels.

Understanding the differences between cloud-based and traditional POS systems helps restaurant operators make more informed technology decisions especially when planning for growth or operational efficiency.

Where Traditional POS Systems Store Data

Traditional POS systems typically rely on on-site servers installed inside the restaurant. These servers store transaction data, menu configurations, and reporting information locally. Terminals connect directly to that internal server to process sales.

While this setup can function reliably in single-location environments, it comes with limitations. Updates often require manual installation. Reporting access may be limited to on-site devices. Adding new locations usually means installing separate servers at each store.

If the local server experiences hardware issues, the entire system can be affected. Maintenance and troubleshooting often require in-person IT support.

How Cloud Architecture Changes The Model

A cloud based pos shifts data storage and processing to secure remote servers rather than relying solely on hardware inside the restaurant. Terminals and devices connect to the cloud through the internet, syncing transactions and updates continuously.

This centralized structure offers several advantages. Reporting dashboards can be accessed remotely. Menu updates can be deployed across locations instantly. Software updates are handled centrally instead of manually at each store.

For multi-unit operators, this architecture makes scaling much simpler. Instead of building separate infrastructure for every new location, additional stores connect to the same centralized system.

Real-Time Data And Visibility

One of the biggest differences between cloud and traditional POS systems is data visibility.

In traditional setups, reporting may depend on exporting files or manually syncing data between systems. Delays are common, especially in multi-location operations.

Cloud systems sync data in near real time. When a transaction occurs at one location, the data updates centrally. Leadership teams can monitor performance across stores without waiting for end-of-day uploads.

This real-time visibility supports faster decision-making, particularly during promotions or peak service periods.

Integration With Kitchen Systems

Modern restaurants rely heavily on digital kitchen workflows. The ability to integrate seamlessly with a kds system is another key difference between cloud and traditional platforms.

Cloud-based systems often provide smoother integration with kitchen displays because they operate within a centralized environment. Orders entered at the POS sync instantly with kitchen screens, and menu updates reflect automatically across all connected devices.

Traditional systems can also integrate with kitchen displays, but updates may require local configuration at each store. This increases the risk of inconsistencies over time.

Supporting Multi-Channel Service

Restaurants today serve guests through multiple channels: dine-in, online ordering, takeout, and drive-thru. Managing these channels through disconnected systems creates complexity.

Cloud POS platforms are generally designed to unify these workflows under one system. For example, integration with a drive thru headset system can be handled within the same centralized environment. Orders taken in the drive-thru feed directly into the POS, kitchen workflow, and reporting dashboard.

Traditional systems may require additional configuration or separate reporting tools to manage these channels effectively.

Maintenance And Updates

Traditional POS systems require manual software updates. Each location may need to install patches individually. If updates are missed or delayed, inconsistencies can appear across stores.

Cloud-based systems typically receive automatic updates deployed centrally by the provider. This ensures that all locations are running the same version of the software without additional effort from store-level staff.

Security Differences

Security practices also differ between the two models. In traditional setups, the restaurant is often responsible for maintaining server security, applying patches, and managing backups.

Cloud-based platforms usually include centralized security management, encryption protocols, and automatic updates. Because updates are handled at the provider level, vulnerabilities can be addressed more quickly across all locations.

Restaurants still need to follow best practices for passwords and network security, but cloud architecture often reduces exposure related to outdated local systems.

Scalability And Growth

With traditional POS systems, opening a new location often requires installing a new server and configuring systems independently. Reporting consolidation can become complicated.

Cloud-based systems allow new locations to connect to the existing infrastructure. Menus, pricing templates, and user permissions can be replicated quickly. This makes expansion faster and more standardized.

For restaurant brands planning multi-location growth, this scalability is a major advantage.

Offline Considerations

A common perception is that traditional systems are more reliable because they operate locally. However, many modern cloud POS platforms include offline capabilities that allow transactions to continue temporarily during internet disruptions.

Once connectivity is restored, stored data syncs back to the cloud. This offers a balance between centralized control and operational resilience.

Final Thoughts

Cloud-based POS systems differ from traditional POS platforms in how they store data, sync information, manage updates, and support multi-location operations. While traditional systems rely on local servers and manual maintenance, cloud architecture centralizes data, enables real-time visibility, and simplifies scalability. With integrated kitchen and drive-thru support, cloud POS platforms provide a more flexible and connected foundation for modern restaurants. For operators planning long-term growth and operational visibility, understanding these differences is essential before choosing a system.

BUSINESS

How Everyday Investors Can Spot Red Flags in Financial Markets

Investing offers a unique pathway to growing wealth and achieving long-term financial stability, but the same financial markets that generate opportunity are also riddled with risks that can challenge even the most experienced investor. The complex and highly dynamic nature of today’s investing landscape means it’s crucial for individuals, especially those without the backing of institutional analysis teams, to stay aware of potential pitfalls and manipulative schemes. Spotting red flags early not only allows you to protect your capital but also positions you to make more informed, rational financial decisions for your future. When confusion or suspicion arises about a potential investment, reaching out to a California securities fraud lawyer brings legal insight and advocacy that can be invaluable in addressing uncertainties or pursuing remedies.

Education is an investor’s most powerful tool, whether you’re just starting out or have years of experience navigating stocks, bonds, or newer assets like cryptocurrencies. The more you understand about the mechanisms behind investments and the tactics scammers use, the more confidently you can proceed. Many bad actors exploit lapses in investor knowledge and leverage urgency or fear of missing out for profit. By continually seeking trustworthy guidance, understanding regulatory frameworks, and investing in your own financial literacy, you strengthen your ability to spot danger before it turns into a loss. Embracing a mindset of skepticism balanced with learning is the foundation of a healthy, long-term investment practice.

Understanding Investment Red Flags

Red flags in financial markets are warning signals that something may be amiss with a particular investment opportunity. These aren’t always overt signs of fraud; sometimes they are subtle clues buried in complicated sales pitches or ambiguous disclosure documents. A red flag might represent anything from the risk of outright fraud to simply a disadvantageous deal presented in a misleadingly attractive way. For most retail investors, recognizing these signs early is essential in minimizing the potential for considerable financial loss and emotional stress. Regularly consulting resources such as the U.S. Securities and Exchange Commission’s published alerts on fraudulent activity can greatly improve your ability to distinguish a sound investment from a potential scam.

Investment fraud appears in various forms. For example, Ponzi and pyramid schemes often lure victims with promises of high, steady returns with no apparent risk, making such opportunities seem “fail-proof.” Alternatively, some schemes involve misleading representations that obscure the true risks or inflate the potential rewards well beyond realistic outcomes. As technology evolves, new vehicles such as speculative cryptocurrencies or unregulated online lending platforms create fresh avenues for deception, often appealing to investors’ curiosity and desire for innovation. Scammers can be persuasive and skilled at psychological manipulation, using sophisticated narratives to earn your trust or pressure you into acting quickly before you have time to think. In these situations, a healthy level of skepticism and a knowledge of common red flags can shield you from devastating losses.

Common Warning Signs

- Guaranteed Returns: No credible investment opportunity can legally promise high, fixed, or guaranteed returns. Investments inherently involve some level of risk, and the possibility of loss is what enables the potential for reward. Claims of steady profits, especially those that seem abnormally high relative to market rates, are red flags for fraud or extremely risky undertakings.

- Unsolicited Offers: Investment invitations that land out of the blue, particularly from individuals or organizations unknown to you, should never be accepted without rigorous vetting. These might come in the form of cold calls, unsolicited emails, or social media messages. Many investment scams, especially those originating overseas, begin with unexpected outreach and the promise of exclusive opportunities.

- Pressure to Act Quickly: Urgency is frequently deployed by fraudsters to prevent potential victims from doing their homework. If someone tells you an opportunity is time-sensitive or must be seized immediately to avoid missing out, slow down. Taking the time to independently verify details is a critical aspect of smart investing—and any reluctance to provide you with that time should raise suspicion.

- Unregistered Products: Before you invest, confirm that both the product and the salesperson are registered with the SEC, FINRA, or your state’s securities regulator. Registration requirements exist to create transparency, and legitimate investments will always have a paper trail you can follow and review. Unregistered or offshore investments are much harder to recover if something goes wrong.

- Complex Strategies: Many scams thrive in opacity. If you cannot easily understand or explain how a proposed investment works to a friend or family member, it’s a sign that either the structure is unnecessarily complicated or details are being deliberately obscured. Complicated language or technical jargon may be used to intimidate or confuse you into silent agreement.

Strategies for Identifying Red Flags

- Conduct Thorough Research: No matter how promising an opportunity appears, always research the company, product, or individual proposing it. Review financial statements, the business’s regulatory standing, and recent news. Trusted financial news outlets can offer insight into public companies, while official court or government filings provide details on legal history and leadership reputation.

- Verify Credentials: Use regulatory agency tools, such as FINRA’s BrokerCheck or the SEC’s database, to verify licensing and disciplinary history. Credentials prove legitimacy and bolster trust, while inconsistencies or disciplinary flags are reasons to walk away.

- Monitor Financial News: Because financial conditions and reputations can change rapidly, staying up to date is key. Watch for sudden shifts in a company’s standing, leadership shakeups, or regulatory investigations, all of which could signal emerging risks that might not have been visible at the outset.

- Seek Independent Advice: Before committing large sums or entering new types of investments, get a second opinion from a fee-only fiduciary or another financial expert who doesn’t benefit directly from your choice. Independent advisors provide honest feedback and may spot issues you’ve overlooked under sales pressure or emotional attachment.

Resources for Investors

Investing doesn’t have to be a solo venture. Many regulators and consumer advocacy organizations provide easily accessible resources designed to help everyday investors make safe, informed choices. The Financial Industry Regulatory Authority (FINRA) is a prime example, offering step-by-step guidance for spotting investment scams and database searches of broker or firm backgrounds. These resources are constantly updated as scammers develop new tactics.

Beyond regulatory bodies, numerous educational platforms and nonprofit consumer advocates offer tools, online classes, and warnings tailored to different experience levels. Government-sponsored websites focus on investor protection, offering checklists, fraud warnings, and Q&A sections to address common concerns and emerging investment trends. Staying proactive and routinely consulting these resources is essential for maintaining a high level of financial awareness.

Conclusion

Financial markets provide opportunities, but the risks cannot be ignored, especially when scam artists are determined to find new ways to separate you from your money. By staying watchful for warning signs like unregistered products, unsolicited offers, and high-pressure tactics, you significantly reduce your chances of falling victim to fraud. Diligence in researching, using trustworthy resources, and seeking knowledgeable independent opinions is the best way to ensure your investments work for you not against you. If a deal seems suspicious or just too attractive for its own good, pause and look deeper; your caution today can safeguard your financial well-being for years to come.

BUSINESS

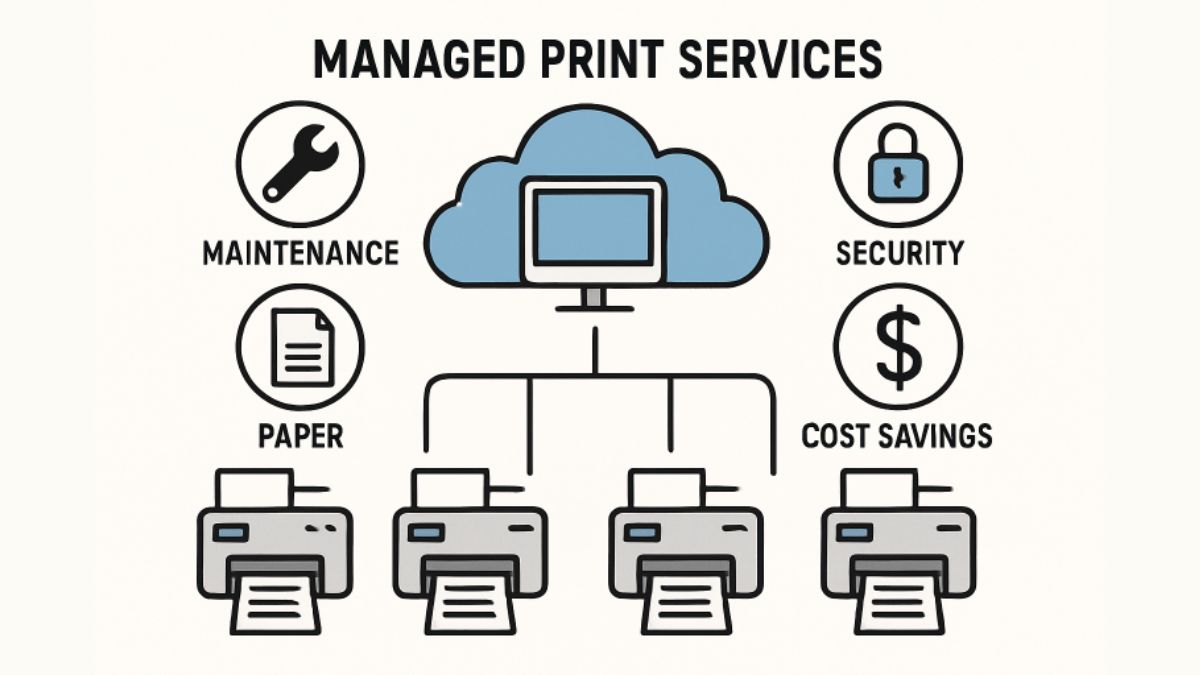

What Are Managed Print Services and How Do They Work?

Introduction to Managed Print Services

Managed Print Services (MPS) have become an essential solution for businesses looking to streamline their printing operations, cut unnecessary costs, and enhance information security. By leveraging the expertise of a dedicated provider, organizations can delegate the responsibility for their entire print environment, from routine maintenance to intricate security measures. Companies like Everworx offer tailored MPS solutions for various industries, ensuring devices run smoothly and workflows remain efficient.

Today’s workplaces demand seamless document processing, quick response times to technical issues, and vigilant security protocols. MPS providers can address all these requirements by proactively managing print devices, optimizing consumable inventory, and recommending improvements based on real-time data. This collaborative approach not only delivers immediate operational benefits but also long-term strategic advantages that foster growth and adaptation in an evolving business landscape.

Key Components of Managed Print Services

Implementing an MPS framework involves a series of well-structured steps, each designed to address specific challenges in document management and output. Here are the essential components that form the backbone of any effective MPS deployment:

- Assessment: This foundational phase involves a thorough evaluation of the existing print environment, identifying inefficiencies, redundancies, and opportunities for consolidation or improvement.

- Optimization: After a thorough assessment, MPS providers work with organizations to streamline printer fleets, improve print workflows, and implement cost-reduction strategies without sacrificing quality or security.

- Proactive Maintenance: Ongoing monitoring and routine maintenance help reduce device downtime, extend hardware lifespan, and minimize disruptions for end users.

- Supply Management: Automated supply replenishment systems eliminate the risk of running out of critical consumables like toner or paper while slashing administrative efforts.

- Security Enhancements: With stricter data protection regulations in place, modern MPS solutions offer advanced security features such as user authentication and encrypted document workflows to safeguard sensitive information.

During the optimization phase, some providers introduce technology that tracks print usage, detects patterns, and provides actionable insights. According to CIO.com, leveraging such technology can reveal surprising sources of wastage, including underutilized devices and inefficient paper workflows, that often go unnoticed in informal print environments.

Benefits of Adopting Managed Print Services

By adopting Managed Print Services, organizations across various sectors can derive measurable benefits that touch on financial, operational, and environmental priorities:

- Cost Reduction: MPS-driven insights target and eliminate wasteful practices, enabling businesses to reduce their print budgets significantly. Industry reports have found that some adopters achieve up to a 50% reduction in printing expenditures.

- Enhanced Productivity: With technical issues preemptively managed, employees are freed from troubleshooting printer problems or dealing with supply shortages. This lets staff focus on value-generating activities instead.

- Improved Security: Secure print solutions, including PIN release and secure print queues, significantly reduce the risk of sensitive documents falling into the wrong hands or being inadvertently left on devices.

- Environmental Sustainability: Optimized print infrastructures result in less paper and toner waste and lower energy consumption. MPS providers often guide organizations toward environmentally responsible practices, aligning with broader corporate sustainability objectives.

One of the hidden benefits of MPS is improved document workflow across departments. Modern MPS solutions can integrate with digital document management systems, enabling seamless transitions from paper-based to digital processes. As noted by CIO.com, the move toward digitization not only increases efficiency but can also improve compliance and auditability for regulated industries.

Implementing Managed Print Services in Your Organization

Integrating MPS into your organization is a transformative process that requires careful planning, provider selection, and ongoing measurement to achieve optimal results. The general process includes:

- Conduct a Comprehensive Assessment: Work with your MPS provider to map your current device landscape, analyze print volume and patterns, and document your specific pain points.

- Select a Reputable MPS Provider: Choose a trusted partner with industry experience and the flexibility to design customized solutions. Assess their support capabilities, technology offerings, and security approach.

- Develop a Customized Strategy: Collaboratively devise a plan for device consolidation, policy enforcement, supply management, and future scalability, all tailored to your key business objectives.

- Implement and Monitor: Launch the agreed solution with minimum disruption. Lean on integrated monitoring tools to regularly gauge device health, usage trends, and the solution’s effectiveness against your defined goals.

Real-World Example: Dell Technologies’ Success with MPS

Many top organizations are embracing Managed Print Services (MPS) to optimize operations and reduce costs. For instance, Dell Technologies partnered with a specialized MPS provider to streamline its entire print fleet and automate helpdesk support for printing issues. This transformation led to a remarkable 60% reduction in print-related support tickets, freeing IT teams from routine troubleshooting. As a result, staff could concentrate on higher-value projects, improve overall service delivery, and enhance operational efficiency. MPS adoption demonstrates how strategic print management can drive both productivity and organizational performance.

Conclusion

In today’s fast-moving business environment, Managed Print Services go far beyond simply reducing paper and toner usage. They offer a comprehensive approach to controlling print-related expenses, streamlining workflows, and improving overall operational efficiency. By centralizing device management, automating supply replenishment, and monitoring usage patterns, organizations gain clearer visibility into costs and performance. Managed Print Services also enhances document security through access controls and tracking features while supporting sustainability initiatives through waste reduction. With the right provider and a strategic rollout plan, companies can transform printing into a valuable, well-managed business asset.

-

TOPIC7 months ago

TOPIC7 months agoSymbols of Hope: The 15th Belenismo sa Tarlac

-

TOPIC7 months ago

TOPIC7 months ago“The Journey Beyond Fashion” – Ditta Sandico

-

NEWS7 months ago

NEWS7 months agoHistorical Churches in Manila

-

TOPIC7 months ago

TOPIC7 months agoRIZAL at 160: a Filipino Feat in Britain

-

TOPIC7 months ago

TOPIC7 months ago5 Must-Have Products From Adarna House to Nurture Your Roots

-

TOPIC7 months ago

TOPIC7 months agoBoats with Two Strings

-

TOPIC7 months ago

TOPIC7 months ago“Recuerdos de Filipinas – Felix Laureano”

-

TOPIC7 months ago

TOPIC7 months agoFilipino, alternative language course at Moscow State University